Money moves lives. Rent to a cousin. A birthday gift to mamá. A quick split after dinner. An app para enviar dinero makes it simple—fast, traceable, calm. This guide shows how these apps work, what fees to expect, how to set up your first transfer, and how to stay safe. Clear steps. No fluff. By the end, you’ll know which app para enviar dinero fits your life, your family, and your budget.

What an App para Enviar Dinero Actually Does

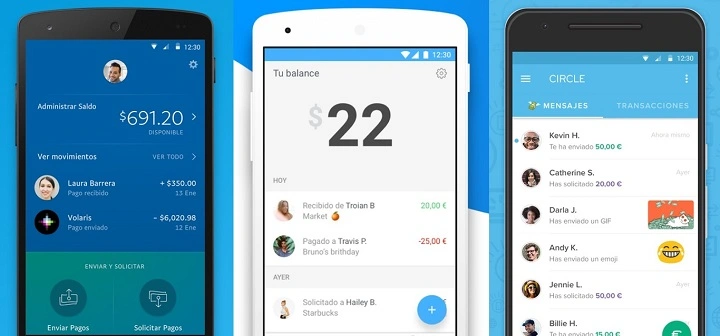

It links three things: your identity, your payment source, and a recipient. The app para enviar dinero verifies who you are, connects to a card or bank, then routes money to a contact or phone number. Some transfers stay inside the same platform wallet; others land directly in a bank account. Timing depends on rails and region. The best part: receipts and status updates live in one tidy thread.

Core Pieces You’ll See in Almost Every App

- Contacts list with country codes and phone/email.

- Wallet balance you can hold or withdraw.

- Bank or card connections for funding and cash-out.

- Transfer speed choices: instant, same day, standard.

- Notifications for sent, received, refunded.

Set Up in Minutes: First Transfer, Step by Step

Create and Secure Your Account

- Download your chosen app para enviar dinero from an official store.

- Sign up by phone or email.

- Turn on two-factor authentication.

- Add a strong passcode or biometric lock.

Connect a Payment Source

- Link a debit card for instant funding.

- Add a bank account for larger, cheaper transfers.

- Confirm micro-deposits if required.

- Set one source as default to speed up future sends.

Verify Your Identity

- Upload a government ID if prompted.

- Take a quick selfie for a match.

- Add legal name, address, date of birth.

Identity checks help your app para enviar dinero prevent fraud and increase your limits.

Send Your First Payment

- Tap “Send.”

- Pick the contact (phone/email/username).

- Enter amount and note (“Rent May,” “Books”).

- Choose the speed and fee option.

- Review. Send. Breathe.

Fees and Speeds: What to Expect

Every app para enviar dinero balances cost and time.

Common Patterns

- Instant to debit: fastest, small fee.

- Standard bank transfer: free or low fee, 1–3 business days.

- International: FX spread + fee; delivery time varies by corridor.

- Card cash advance: avoid; use debit, not credit, where possible.

A Simple Rule

If it’s urgent, pay a bit more for speed. If it can wait, choose standard and keep fees low. Your app para enviar dinero should show the total cost before you hit “Send.”

Domestic vs. International: Know the Path

Domestic Transfers

- Often wallet-to-wallet or bank-to-bank within the same country.

- Instant options are common, especially to debit cards.

- Minimal data needed: name + phone/email.

Cross-Border Transfers

- Requires recipient country, bank details or wallet, sometimes address.

- FX rates matter. Compare total received, not just posted rate.

- Some app para enviar dinero services offer cash pickup partners; others deposit straight to bank or mobile wallet.

Security Essentials That Protect Your Money

Safety is a habit, not a button.

Before You Send

- Confirm the contact: one digit wrong can send money to a stranger.

- Use saved recipients inside your app para enviar dinero, not copy-pasted numbers from random chats.

- Never share one-time codes. Ever.

Ongoing Protection

- Lock the app. Lock your phone.

- Turn on transaction alerts.

- Review monthly statements.

- Revoke old devices from your account settings.

How to Choose the Right App for You

Match Features to Real Life

- Family support abroad? Pick an app para enviar dinero with fair FX and cash pickup options.

- Roommate bills? Look for QR splits, request links, and instant bank deposits.

- Small business? Prioritize receipts, exports, and clear payout schedules.

Compare What Truly Matters

- Total cost (fee + FX).

- Speed to the recipient.

- Limits for new vs. verified accounts.

- Supported countries and IDs.

- Customer support that answers when things go wrong.

Avoiding Scams Without Losing Kindness

Red Flags

- “Urgent” requests from new numbers or sudden “phone lost” stories.

- Sellers ask you to mark a payment as “friends & family” to dodge fees.

- Anyone pushing you off the app para enviar dinero to private links.

Safer Habits

- For marketplace deals, use buyer protections where available.

- Send a tiny test amount first for new recipients.

- Use in-app chat for a paper trail; avoid side DMs when possible.

When a Transfer Fails—or You Sent the Wrong Amount

If It’s Pending

- Cancel if the option exists.

- Contact support inside your app para enviar dinero with the transfer ID.

If It’s Completed

- Ask the recipient to refund in-app.

- File a dispute if the transfer violated platform policy.

- Document everything: screenshots, timestamps, chat logs.

Budgeting and Limits: Stay in Control

Keep Your Weekly Rhythm

- Set a weekly send limit inside your app para enviar dinero.

- Use scheduled transfers for rent or remittances; fewer last-minute fees.

- Tag payments (Family, Bills, Gifts) so month-end summaries make sense.

Know Your Caps

- Unverified accounts: small daily/weekly limits.

- After ID checks: higher caps and international corridors.

- Large transfers may need source-of-funds proof. Keep pay stubs or invoices handy.

Taxes and Receipts: The Quiet Admin You’ll Thank Yourself For

- Export monthly CSVs for your records.

- Label business vs. personal.

- Some countries require reporting above thresholds. Your app para enviar dinero receipts will save time at filing season.

Practical Scenarios (So You’re Ready)

Split a Restaurant Bill

- One person pays.

- Others scan a QR or tap your profile to send exact shares.

- Add a note so it’s clear later.

Rent to a Private Landlord

- Set a monthly schedule.

- Include the apartment number in the note.

- Save the receipt PDF to your cloud folder.

Gift to Family in Another Country

- Compare two services for total received.

- Check whether mobile wallet, bank deposit, or cash pickup serves them best.

- Send mid-week; some corridors process faster outside weekends.

Troubleshooting Checklist

- Does the app verify your ID? Clean the camera, use natural light, remove hats/glasses glare.

- Bank link fails? Try instant verification via your bank login; if not, use micro-deposits and confirm the next day.

- Transfer stuck? Check maintenance notices, then contact support with the transaction code.

A Calm 10-Minute Setup Plan

- Install one trusted app para enviar dinero.

- Enable two-factor and a passcode.

- Link debit and bank.

- Verify identity fully.

- Add two frequent recipients.

- Send a $1 test.

- Turn on alerts and weekly limits.

- Save your support PIN in a password manager.

Small steps. Big peace of mind.

FAQs

What is an app para enviar dinero in simple terms?

A mobile service that lets you send money to contacts or bank accounts, locally or abroad, with receipts and delivery status in one place.

Is it safe to use an app para enviar dinero for everyday payments?

Yes, when you enable two-factor, lock the app, verify recipients, and avoid sending to unknown sellers without protection.

How fast does money arrive with an app para enviar dinero?

Instant to wallet or debit is common with a small fee; standard bank transfers can take 1–3 business days. Cross-border timing depends on the corridor.

What fees should I watch for in an app para enviar dinero?

Instant delivery fees, FX spreads on international transfers, and cash-out fees. Compare the total received amount, not just posted rates.

Can I use an app para enviar dinero for business?

Yes—many support invoices, QR payments, and exports. Keep personal and business transfers separate for clean records.